By Dennis Speigel

Continuing his series of articles on the attractions industry, International Theme Park Services (ITPS) president Dennis Speigel looks at the ongoing global growth of the leisure industry and notes, among other factors, that simply building major theme parks and attractions doesn’t guarantee the required numbers of visitors will come

AS we continue to watch the leisure industry’s growth globally, it appears we have never worked in a time of such enormous activity.

In past issues, we have talked about several markets which are under scrutiny, yet remain under serious development as they proceed with genuine planning and have prospective ongoing exploration of new attractions.

These markets are China, the Middle East (Abu Dhabi, Saudi Arabia, Qatar) and Russia. We’ve seen over the course of the last few years the frustration and lack of performance experienced by the operators of the parks in Dubai, with the exception of Global Village, a Dubai amusement attraction park that drew approximately 5.6 million plus in attendance last year. None of the other parks in Dubai have hit their original attendance projections. Since opening, some of these parks, which were designed and built to accommodate 40,000 people on any given day, historically have drawn 10 per cent of the daily anticipated projections. The exception for large attendance is Ramadan and Eid.

We have seen parks flounder, we have seen amusement park deals collapse – like the Six Flags Dubai park project – and in China as well we have seen the theme park market take dramatic shifts caused by the Chinese government placing moratoriums on greenfield parks and real estate developers who use theme parks to attract residential and commercial activity, “a loss leader.”

This is not a new approach or surprise for those of us who have worked on leisure in the Middle East and China for over three decades. There have been similar slowdowns, moratoriums and government involvements before and there has been bounce back. Leisure, theme park, waterpark and family entertainment centre projects continue to emerge and develop. It seems like the old adage “one step forward, two steps back” is sometimes at work in China! However, I like to think positive and believe it is a “two steps forward and one step back” process, moving ahead but on a more cautious, slower path and approach.

Projects have been announced over and over in both of these markets. As I pointed out, Six Flags has had the plug pulled or partially pulled in China, Vietnam and Dubai. SeaWorld has had projects cease in both China and Dubai.

When doors close, we know other doors open. For Six Flags, it is Saudi Arabia. It has been announced that they will open a theme park there in 2022 and behind this project is reportedly the Royal Family. But Royal Family or not, the question is, and remains, is the Saudi market up to the mass development plan being put forth? Hopefully, they have learned from the Dubai experience but once again, just because they build it does not mean “they” will come. Population, tourism, location and infrastructure are all required upfront to assist and help ensure success. Fees can be taken by operators, it helps them look good on their quarterly statements, but when the projects evaporate, how does it look then? Wanda, Country Garden, Riverside and Evergrande all hit major snags for various reasons.

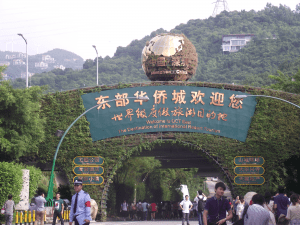

One thing is for sure though – the Chinese market is currently underserved with leisure of this type. We see park groups like Chimelong, OCT, Songcheng and Fantawild taking smart steps to add to their portfolios of attractions. Why? They are genuine, true theme park operators. So, their activity is studied, focused and built on historical practice, not the “loss leader” concept.

Disney, and now Universal, both have deeply committed properties in China. 1.4 billion people can cure a lot of investment worries and a well-known international IP can make a major difference to people’s desire to visit.

For other parts of the globe, more basic baby steps need to be taken as it relates to building, with some well-tested feasibility footing. If this is not done properly, we will continue to see withdrawals and we will see hundreds of millions in investments committed, then stalled. We will see fees paid for IP only to evaporate due to the indefinite stalling of projects. This is not the way for the industry to grow. Let’s make sure the market conditions are there in every feasibility sense of study. Then, and only then, can we proceed with the “ground breakings,” and successes.

Dennis Speigel is president of International Theme Park Services (ITPS), based in Cincinnati, Ohio, USA. A past chairman of the International Association of Amusement Parks and Attractions (IAAPA), he has over 50 years of experience in the theme park and leisure industry. Since its inception in 1983 ITPS has worked on over 500 projects in 50 countries and is uniquely qualified to assist in all aspects of entertainment project development.

www.interthemepark.com